Information around the Clean Car Discount Scheme is pretty confusing for most of our clients. Here’s what we have to say about the scheme…

It seems to us that most people understand the Clean Car Discount Scheme to be as simple as getting rebates on EV and PHEV vehicles, or being taxed when they buy the next fossil fuel driven vehicle, with no exceptions. The common view is that big bad naughty utes are on the way out and will be taxed hard!

To top it all off this week, we have seen The Motor Industry Association of New Zealand withdraw its support for the government’s “Clean Car Plan” saying that the legislation required to make it work is highly flawed.

Well surprise, surprise! Will the launch of stage 2 of the programme actually kick off on time or at all next year?

Taxes, rebates and the Clean Car Discount Scheme

So back to the taxes, rebates and the Clean Car Discount Scheme. Once you look deep into the current setup you will see that it’s not all it seems.

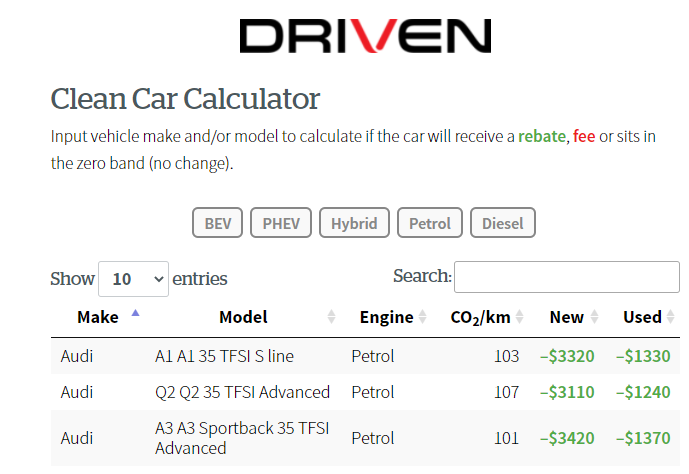

It’s not just EVs and PHEVs that will be rewarded with rebates, but many diesel and petrol vehicles too, which is good news to many and may well be a surprise to most.

Having a quick flick through the lists I see a Volkswagen Caddy diesel van, for example, with a $1,100 rebate. Also a Toyota Yaris petrol with a whopping $3,620 rebate. Seems there are plenty of diesel and petrol vehicles that will qualify for rebates under the scheme.

So let’s be clear that it’s not all about electric, it’s all about carbon emissions.

As such, if a car’s emissions fall below a certain magical figure then that vehicle will be in line for a nice big rebate, and that goes for those big evil utes out there as well if they get their act together in the future.

If the emissions are above that magic figure, then it’s tax time. The government hates us using the term “TAX” in this instance but let’s be clear, it is what it is.

How to claim your Clean Car Discount Scheme rebate

So, hands up if you know how to go about claiming your big fat rebate when you buy your next low carbon emitting emissions qualifying vehicle?

Well, you would have thought the easiest way would have been to have it managed at source, i.e. at the dealership where you go to purchase this pure-as-the-driven-snow vehicle?

But wait, no, that is far too logical… you need to go online and process a whole bunch of paperwork and then have the fund which manages it (if it has funds available, as per GOVT disclaimer) pay you back the rebate amount you are entitled to.

In our view this is ridiculous.

The majority of our clients will have this applied back into their financing arrangement. If it’s by lease then we will be managing this effectively on their behalf as it will be applied back to the lease payments, so it’s not so much of an issue.

But if it’s by way of traditional financing/hire purchase we possibly have a bigger issue. In this case we must either have a structured finance payment organised, or the client is forced to front an amount equal to the rebate out of their pocket while they wait for the refund. This is not always ideal or practical.

Who to talk to for advice

All our team here are up with the play on the Clean Car Discount Scheme. If you want some advice on how this will be applied to your next vehicle purchase or lease then give us a call on 0800 275-374 or contact us here

Clean Car rebate/tax calculator

For the best CLEAN CAR REBATE/TAX CALCULATOR available to get a gauge on what the rebate or tax would look like, check out the Driven section of the NZ Herald HERE